專題

專題

ACCA考試科目一共有15門,其中F2為《管理會(huì)計(jì)》,這門科目的主要內(nèi)容是關(guān)于管理會(huì)計(jì)體系的主要元素和管理會(huì)計(jì)的作用,其中涉及較多的知識(shí)點(diǎn)多且雜,如管理會(huì)計(jì),管理信息,成本會(huì)計(jì)等,考試難點(diǎn)較多,F(xiàn)2《管理會(huì)計(jì)》重點(diǎn)難點(diǎn)資料,具體如下:

1.Target cost=target selling price–target profit=market price–desired profit margin.

2.cost gap=estimated cost–target cost.

3.TQM:

①preventing costs

②appraisal costs

③internal failure costs

④external failure cost

4.Alternative costing principle:

①ABC(activity based costing)

②Target costing

③Life cycle

④TQM

8.Time series:

①trend

②seasonal variation:⑴加法模型sum to zero;⑵乘法模型sum to 4

③cyclical variation

④random variation

9.pricipal budget factor關(guān)鍵預(yù)算因子:be limited the activities

10.budget purpose:

①communication

②coordination

③compel the plan

④motivative employees

⑤resource allocation

11.Budget committee的功能:①coordinated②administration

12.Budget:①function budget②master budget:1.P&L;2.B/S;3.Cash Flow

13.Fixed Budget:不是在于固不固定,而是基于一個(gè)業(yè)務(wù)量的考慮,financail expression.

Flexible Budget:包含了固定成本和變動(dòng)成本,并且變動(dòng)成本的變化是隨著業(yè)務(wù)量的變化而改變。

14.Flexible Budget的優(yōu)點(diǎn):

①recognize different cost behavior.

②improve quality and a comparison of like with like

③help managers to forecast cost,revenue and profit.

15.Flexible Budget的缺點(diǎn):

①假設(shè)太簡(jiǎn)單。

②需要更多的時(shí)間準(zhǔn)備預(yù)算編制。

16.Controllable cost is a“cost which can be influenced by”its budget holder.大部分的變動(dòng)成本是可控的,non-controllable cost為inflation.

17.Budget Behavior:

①participate approach

②imposed budget

18.payback投資回收期的缺點(diǎn):

①ignore profitability

②the time value of money is ignored

③沒有考慮項(xiàng)目后期帶來的經(jīng)濟(jì)利益

④arbitray武斷

19.payback投資回收期的優(yōu)點(diǎn):

①easy to calculate

②widely use

③minimize the effect of the risk and help liqidity

★如果在算投資回收期的時(shí)候,發(fā)生折舊,則需要加回折舊,因?yàn)檎叟f是非現(xiàn)金項(xiàng)目。

20.(1+real interst rate)*(1+inflation rate)=(1+nominal interest rate)

21.NPV=present value of future net cash flow–present value of initial cost

22.永續(xù)年金=A/i

23.每年的匯報(bào)是相同的就查看年金現(xiàn)值系數(shù)表,不同的就查看年金系數(shù)表。

24.EAR=CAR=APR=(1+r/n)n–1有效年利率

25.IRR:(based on cash flow analysis)

①IRR>cost of capital,NPV>0,worth taking

②IRR<cost of capital,NPV<0,not worthwhile.

26.ARR=average profit/average investment(ARR是基于profit)

Average investment=(initial investment–residual value)/2

27.type of standard:

①basic standard

②current standard

③ideal standard

④attainable standard

28.Variance

ⅠMaterial Variance

⑴total material variance=standard cost–actual cost

⑵material price variance=(standard price–actual price)*actual quantity

⑶material usage variance=(standard usage of actual output-actual usage)*standard price.

ⅡDirect Labor Variance

⑴standard pay–actual pay

⑵Labor rate variances=(standard rate–actual rate)*actual hrs of actual output

⑶Labor efficiency variances=(standard hrs of actual output–actual hrs)*standard rate

ⅢVariable production overhead variances

⑴Total variable O.H.variance=standard cost–actual cost

⑵Variable O.H.expenditure variance=(standard rate–actual rate)*actual hrs

⑶Variable O.H.efficiency variance=(standard hrs of actual output–actual hrs)*standard rate

ⅣFixed O.H.expenditure variance

⑴Fixed O.H.Expenditure variance=budget expenditure–actual expenditure

⑵Fixed O.H.volume=(actual output-budgeted volume)*standard hrs per unit*standard rate per hr.

⑶Capacity variance=(actual hrs worked–budgeted hrs worked)*standard rate per hr

⑷Efficiency variance=(standard hrs worked for actual output–actual hrs worked)*standard rate per hr⑴+⑵:Fixed O.H.total variance=fixed O.H.absorbed–actual expenditure

ⅤSales variance

⑴Sales price variances=(actual price–budget price)*actual sales units

⑵Sales volume variances=(actual sales units–budget sales units)*standard profit per unit

(absorption)

⑶Sales volume variances=(actual sales units–budget sales units)*standard CPU(marginal costing)

ⅥIdle time variances

Idle time variance=(expected idle time–actual idle time)*adjusted hr rate

29.The elements of a mission statement including:

①Purpose

②Strategy

③Policies and standards of behavior

④Values and culture

30.A critical success factor is a performance requirement that is fundamental to competitive success.

31.Profitability ratios

①Return on capital employed(ROCE)

=profit before interest and tax/(shareholders’funds+long-term liabilities)×100%

②Return on equity(ROE)=profit after tax/shareholders’funds×100%

③Asset turnover=sales/capital employed×100%

=sales/(shareholders’funds+long-term liabilities)×100%

④Profit margin=profit before interest and tax/sales×100%

Profit margin×asset turnover=ROCE

32.Debt and gearing ratios

①Debt-to-equity ratio=long-term liabilities/total equity×100%

②Interest cover=PBIT/Interest×100%

33.Liquidity ratios

①Current ratio=current assets/current liabilities

②Quick ratio(acid test ratio)=current assets minus inventory/current liabilities

34.Working capital ratios

①Inventory days=average inventory*365/cost of sales

②Receivables days=average trade receivables*365/sales

③Payables days=average trade payables*365/cost of sales(or purchases)

35.Non-financial performance measures

Non-financial performance measures are considered to be leading indicators of financial performance.

①M(fèi)arket share

②Innovation

③Growth

④Productivity

⑤Quality

⑥Social aspects

36.The balanced scorecard:

①financial perspective

②external perspective

③customer perspective

④learning and innovation perspective

37.Benchmarking:

①Internal benchmarking

②Competitive benchmarking

③Functional benchmarking

④Strategic benchmarking

38.Value analysis is a planned,scientific approach to cost reduction,which reviews the material composition of a product and the product's design so that modifications and improvements can be made which do not reduce the value of the product to the customer or user.

39.Four aspects of'value'should be considered:

①Cost value

②Exchange value

③Utility value

④Esteem value

40.ROI=PBIT/capital employed*100%

Widely used and accepted;As a relative measure it enables comparisons to be made with divisions or companies of different sizes.

41.RI=PBIT-Imputed interest*capital employed.

Possible to use different rates of interest for different types of assets;Cost of finance is being considered.

從2024年起,CFA ESG課程大綱的版本不再沿用之前的v1、v2版本叫法,比如2023年CFA ESG是v4版。取而代之的是全面按照年份來區(qū)分。2024年新的課程大綱即為CFA ESG v2024。

一、整體變動(dòng)

2024版內(nèi)容相比2023版整體縮減10%,這對(duì)于考生來講是個(gè)好消息。

整體結(jié)構(gòu)保持不變,依然是9大章節(jié)。

二、章節(jié)變動(dòng)

Chapter 2

第二章去掉了“ESG投資歷史”部分,這表明協(xié)會(huì)致力于關(guān)注當(dāng)下最新內(nèi)容。(見下圖)

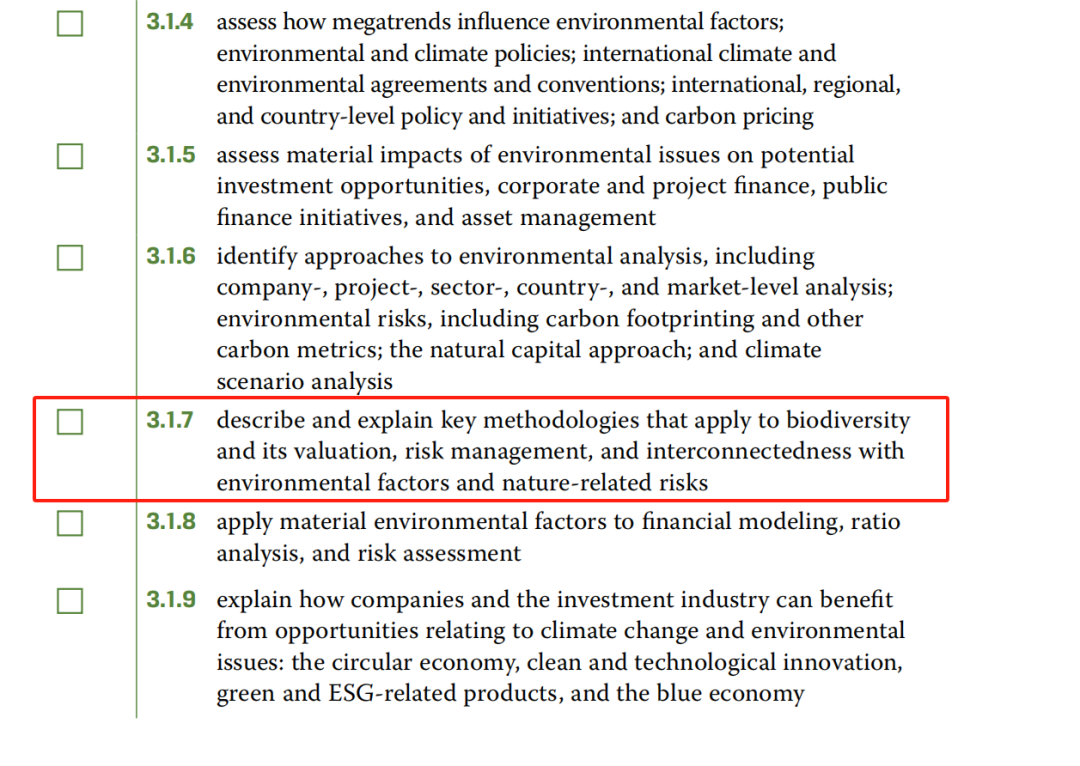

Chapter 3

在第三章“環(huán)境因素”中,2024年大綱增加了有關(guān)生物多樣性的內(nèi)容,包括其評(píng)估、風(fēng)險(xiǎn)管理以及與環(huán)境因素和自然相關(guān)風(fēng)險(xiǎn)的相互關(guān)聯(lián)性。(3.1.7)(見下圖)

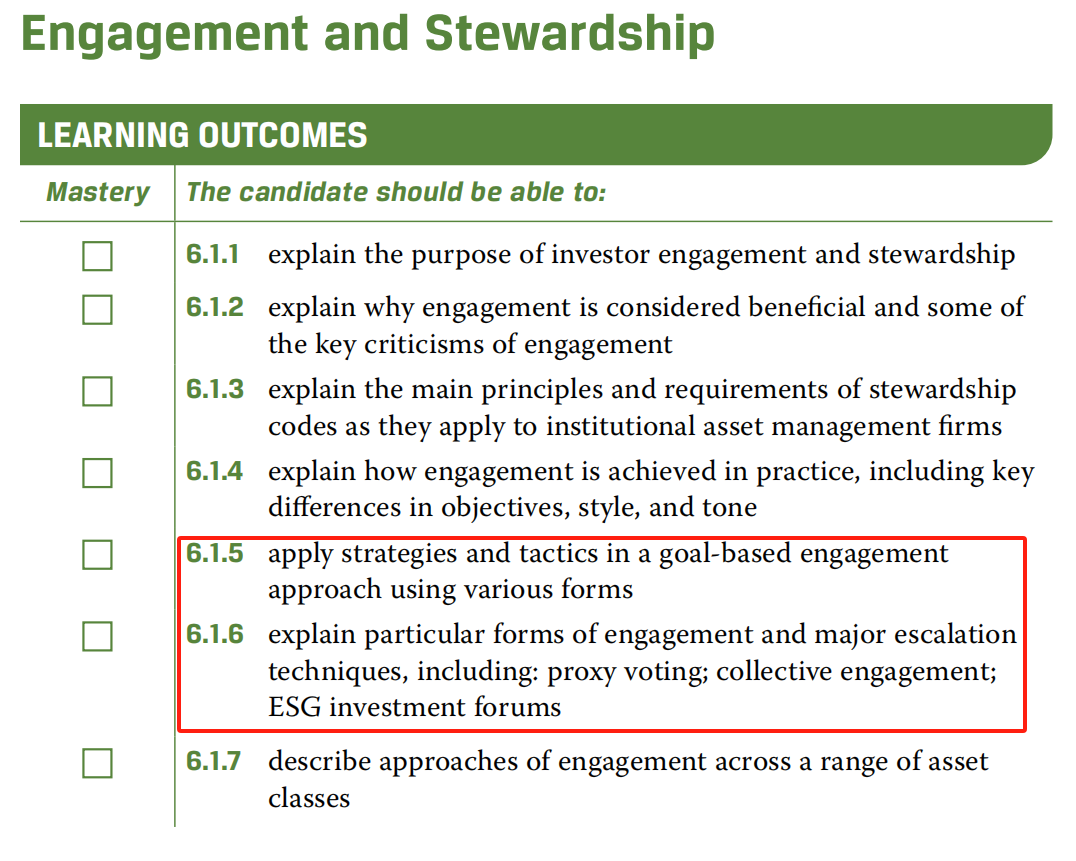

Chapter 6

在第六章“參與和管理”中,2024年大綱細(xì)化了參與策略和戰(zhàn)術(shù)的應(yīng)用,并說明了特定參與形式和主要升級(jí)技術(shù),包括代理投票、集體參與和ESG投資論壇。(6.1.5和6.1.6)(見下圖)

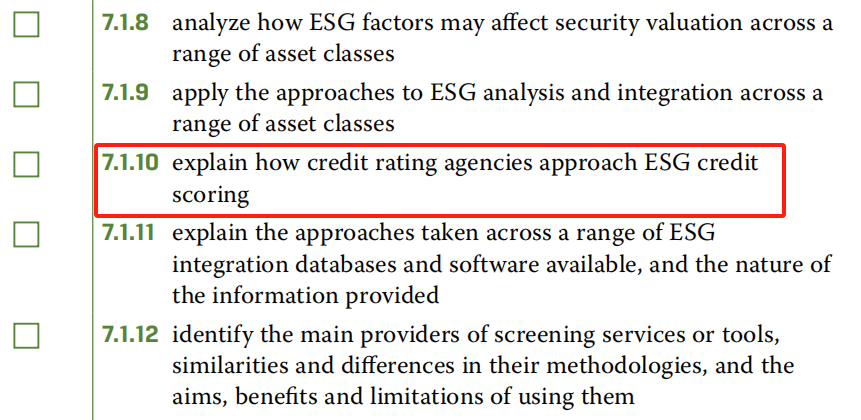

Chapter 7

第七章是此次大綱修訂變化最大的部分。整章內(nèi)容進(jìn)行了重組,2023版本的21個(gè)小節(jié)內(nèi)容大幅縮減為2024版的14個(gè)小節(jié),可以理解為縮減了幾乎三分之一的內(nèi)容。

在第七章“ESG分析、估值與整合”中,2024年大綱對(duì)整合ESG分析到投資過程的描述進(jìn)行了簡(jiǎn)化,并且增加了對(duì)信用評(píng)級(jí)機(jī)構(gòu)處理ESG信用評(píng)分的解釋。(7.1.10)(見下圖)

Chapter 8

在第八章“綜合投資組合構(gòu)建與管理”中,2024年大綱對(duì)管理基于指數(shù)的ESG投資組合的描述做了細(xì)微調(diào)整。(8.1.10)(見下圖)

Chapter 9

在第九章“投資任務(wù)、投資組合分析與客戶報(bào)告”中,2024年大綱新增了對(duì)金融市場(chǎng)參與者“漂綠”行為及監(jiān)管和后果的內(nèi)容,反映出業(yè)界對(duì)于ESG聲明真實(shí)性的嚴(yán)格審查,以及解決ESG行業(yè)內(nèi)漂綠行為的日益重要性,幫助考生在日后的工作中應(yīng)對(duì)此種復(fù)雜問題的準(zhǔn)備(9.1.4)(見下圖)

三、2024考試大綱權(quán)重變化

Topic | 2024 Topic Weight | 2023 Topic Weight |

Introduction to ESG Investing | 7% | 8-15% |

The ESG Market | 6% | |

Environmental Factors | 12% | 8–15% |

Social Factors | 12% | 8–15% |

Governance Factors | 11% | 8–15% |

Engagement and Stewardship | 9% | 5–10% |

ESG Analysis, Valuation and Integration | 21% | 20–30% |

Integrated Portfolio Construction and Management | 13% | 10–20% |

Investment Mandates, Portfolio Analytics, and Client Reporting | 9% | 5–10% |

從考綱權(quán)重對(duì)比情況來看(見上圖),協(xié)會(huì)對(duì)于ESG知識(shí)點(diǎn)考察更加精細(xì),可以直接精確到題目的數(shù)量。

目前來看,第7章和第8章以及ESG三要素的考點(diǎn)占據(jù)多數(shù)。考生們對(duì)于這幾個(gè)章節(jié)的復(fù)習(xí)也應(yīng)該投入更多時(shí)間和精力。

四、2024 Curriculum更新

CFA協(xié)會(huì)剛剛正式發(fā)布了2024版curriculum的更新內(nèi)容,9個(gè)章節(jié)均有調(diào)整。主要增加了新的案例分析、新的數(shù)據(jù)圖表和更多的練習(xí)題。

如第一章 更新內(nèi)容:

Key Enhancements

·ESG 2024(v5)Chapter 1 includes 33 total practice questions,featuring 8 additional Practice questions vs.2023(v4).

New Content

·Update on Blackrock’s implementation of 2020 ESG commitments

·34%of world’s largest companies committed to Paris Agreement

·Added Brazilian example to water depletion case study

·Noted costs for corporate issuers and institutional investors for climate-related disclosures and reporting

·Updated growth of new PRI signatories

·Recognized launch of ISSB reporting standards for 2024

Removed Content

·Exhibit 3–Guide to ESG reporting that was simplistic and duplicitous

·Exhibit 5 illustrative/hypothetical example of benchmarking that was poorly constructed by MSCI

·Coca-Cola water depletion case study example from 2004

·2014 study analyzing data from the global climate database provided by CDP

·“estimated that companies experience an average internal rate of return of 27%–80%on their low-carbon investments”

·2014 reference to Walmart increasing their fleet efficiency by 87%

·Reduced greenwashing references as there is new content in other chapters

·Explanation of what a meta-analysis is

LOS related

·No changes

完整版esg大綱查看:2024年CFA-ESG考試大綱

ESG考試常見問題答疑

一、官網(wǎng)注冊(cè)并繳費(fèi)

2024年考試費(fèi)為865美金,重考費(fèi)690美金

考生可另外支付135美元與運(yùn)費(fèi)來獲得紙質(zhì)版的教材。

中國(guó)內(nèi)地暫無線下考試考點(diǎn),但可選擇線上考試。

報(bào)名時(shí)需要選擇CFA Hongkong協(xié)會(huì)進(jìn)行掛靠。

ESG退費(fèi)政策:

可在付款后14天內(nèi)(至東部時(shí)間第14天晚上11:59)全額退還注冊(cè)費(fèi)。初始注冊(cè)不包括為重新安排由考生推遲或由CFA協(xié)會(huì)推遲的考試而進(jìn)行的注冊(cè)。由于匯率波動(dòng),CFA協(xié)會(huì)不能保證支付給CFA協(xié)會(huì)的確切金額將以美元以外的貨幣退還。

二、報(bào)名時(shí)間

ESG投資證書考試無固定考季,支持線上考試,隨時(shí)報(bào)名,隨時(shí)約考,即時(shí)出成績(jī)。

題目:CFA協(xié)會(huì)ESG投資證書考試包括100道選擇題(英文)。

時(shí)長(zhǎng):2小時(shí)20分鐘內(nèi)完成

溫馨提示:注冊(cè)后,有長(zhǎng)達(dá)6個(gè)月的時(shí)間來安排和參加Prometric考試。

報(bào)名入口:CFA協(xié)會(huì)官網(wǎng)(網(wǎng)址:https://www.cfainstitute.org/)

三、預(yù)約考試

完成注冊(cè)后,考生最多能有6個(gè)月的時(shí)間預(yù)約考試。

四、考試形式

100道單項(xiàng)選擇題(3個(gè)選項(xiàng)),時(shí)長(zhǎng)2小時(shí)20分鐘。考試結(jié)束后可立即得到結(jié)果:通過/未通過,稍后在CFA賬戶中也會(huì)提供(考試不允許使用計(jì)算器)。

以上就是全部?jī)?nèi)容,想要了解更多關(guān)于CFA ESG相關(guān)政策,請(qǐng)?jiān)L問【報(bào)考指南】欄目!一鍵輕松GET CFA ESG報(bào)名、考試費(fèi)用、考試動(dòng)態(tài)、證書等全面信息!